Finde und kaufe deine Wohnung

Von der Wohnungssuche bis zur Finanzierung. Alles aus einer Hand.

In fünf einfachen Schritten zur Traumwohnung.

Wir begleiten deinen Wohnungskauf von der Suche bis zur Schlüsselübergabe.

- Finden Suche gezielt oder lass dich inspirieren – von Wohnungen in den besten Lagen.

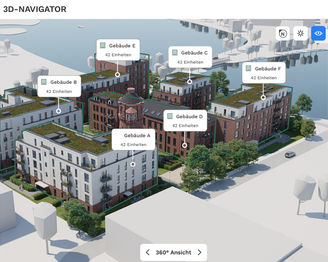

- Erleben Schau dich in deiner Wohnung um, digital oder vor Ort. Buche kostenlos und unverbindlich Beratungstermine.

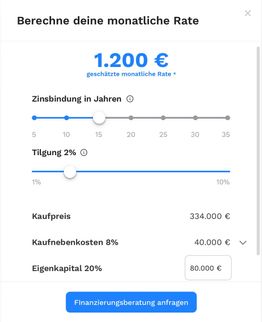

- Finanzieren Prüfe deine finanziellen Möglichkeiten und nutze unsere individuellen Finanzierungsangebote zu besten Konditionen.

- Reservieren Sicher dir deine Wunschimmobilie mit wenigen Klicks direkt online und starte den Kaufprozess.

- Kaufen Glückwunsch! Auch nach dem Kauf sind wir weiter für dich da und versorgen dich mit allen relevanten Informationen und Unterlagen.

Wo willst du wohnen?

Suche in unseren Top-Städten

Lass dich inspirieren

Entdecke neue und empfohlene Wohnungen.

Finde, kaufe und finanziere deine Eigentumswohnung auf allmyhomes. Einfach, selbstbestimmt und digital.